The dream of recurring revenue and the reality of subscription fatigue

Start looking at Recurrent Revenue with the eyes of your customers to avoid Subscription Fatigue: 3 major readjustments emerging in the subscription landscape

From streaming services to fitness apps, we willingly hand over our credit cards, lured by the promise of seamless access and ongoing value. But what happens when the music stops and the fatigue sets in? Are subscriptions always the answer, or is the growing trend of “subscription fatigue” a sign we’ve reached peak recurring revenue? And what does this mean for businesses based on recurring revenue?

A world of subscriptions

The “as a Service” revolution, starting with SaaS pioneers like Salesforce, reshaped software delivery, and subscriptions became synonymous with tech products. This trend then blossomed into a wider phenomenon, encompassing everything from razors to pet food, often painting “one-off sales” as outdated relics of the past. Fueled by investor expectations, many startups prioritized recurring revenue models, proudly showcasing impressive Annual Recurring Revenue (ARR) figures.

Software (B2B and B2C) transitioned from product-based models to service-oriented deliveries, leading to wider sector adoption. Media consumption, with giants like Netflix and Spotify, revolutionized access to entertainment, setting new standards for how we engage with content.

In the B2B software realm, the adoption of SaaS models has led to a significant reduction in upfront costs for businesses, facilitating access to state-of-the-art software without the hefty price tag of traditional licensing models. For consumers, the shift to subscription-based media consumption has not only democratized access to vast content libraries but also introduced a new era of personalization and convenience. Netflix, for instance, reported over 200 million subscribers worldwide by the end of 2020, illustrating the massive appeal of subscription models in media.

And subscriptions don’t stop at the edges of the digital world: the so-called “e-commerce subscription” market (consisting of the delivery of physical goods and services through a subscription model), according to a report from McKinsey in 2018, has been on a constant rise throughout the second decade of the century (https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/thinking-inside-the-subscription-box-new-research-on-ecommerce-consumers). The largest retailers in this space generated more than $2.6 billion in sales in 2016, up from a mere $57.0 million in 2011. The same market is expected to reach $120 Billion in sales by 2026 ( https://www.forbes.com/sites/jiawertz/2022/07/15/the-growth-of-subscription-commerce/ )

This staggering growth underlines the shift towards recurring revenue models across industries, not just in technology but also in traditional sectors seeking innovation through subscriptions.

Recognizing the signs of subscription fatigue

Subscription fatigue emerges as subscribers become overwhelmed with continuous engagement and rising costs. The accumulation of subscriptions prompts regular spending reviews, leading to service cancellations and additional friction in acquisition. This results in increased difficulty in acquiring new subscribers and higher churn rates.

This trend is not that new: already in 2020, in the middle of the Covid “digital” surge, a survey by UBS Evidence Lab found that 25% of consumers planned to reduce their subscription services, citing cost and underuse as primary reasons. This trend is especially pronounced in the entertainment sector, where options abound, and consumers are more vigilant about managing their subscription portfolios. The churn rate in the digital media sector can be as high as 25-30%, showcasing the volatility and the challenges of maintaining subscriber loyalty.

As we all can imagine, with 2024 marked high inflation and a lowered purchase power is not going to make anything better.

In other words, subscribers start to show signals of fatigue and higher scrutiny of cost when it comes to subscriptions. Not only cost “per se”, but also in terms of Total Cost of Subscriptions (aka. How big is my total subscription bill this month) and Total Cost of Ownership for a given service (aka how much this service will cost me over my lifetime/full ownership time).

Even in the case of cloud services, which changed the way we looked at IT 10 years ago, many companies are recalculating the cost-benefit of transitioning to on-premises infrastructure or private clouds.

We expect that this whole fatigue and a more rational reassessment of subscriptions will lead to three major readjustments in the world of subscriptions:

- On services that are losing value because of fragmentation (eg. Video Streaming)

- On e-commerce subscriptions, where the value drivers are shifting

- On the goods where a subscription pricing model was a stretch in the first place

Recurrent value before recurrent revenue: the gap between business and customers

From a business standpoint, the appeal of subscriptions is undeniable. Predictable, recurring revenue is a goldmine for predictability and valuations, offering a clear view of financial health and growth potential. However, this focus on ARR can sometimes lead to strategies prioritizing business needs over customer satisfaction, contributing to the subscription fatigue companies seek to avoid.

Many companies, blinded by the recurring revenue dream, start seeing the world solely through their lens, neglecting the perspective of the customer. While subscriptions make perfect sense in some cases, in others, they’re a forced fit, a clumsy attempt to squeeze a square peg into a round hole. This “bad optimization” prioritizes the company’s desire for recurring revenue over understanding and meeting the needs of the customer, a strategy that cannot pay off in the long run.

Companies laser-focused on the acquisition, blinded by the dream of endless recurring revenue streams, often fall into the trap of taking customer loyalty for granted. They forget that loyalty needs to be earned, nurtured, and built upon genuine value and positive experiences.

While businesses optimize for recurrent revenue, customers are looking for recurrent value.

The allure of ARR may be strong, but the reality can be harsh. Just look at Blue Apron’s story. In 2017, at their IPO, they boasted a staggering $400 customer acquisition cost (CAC) (source: https://www.inc.com/erik-sherman/blue-apron-has-a-very-big-problem-that-can-plague-any-entrepreneur.html). However, average revenue per customer simply wasn’t high enough to support this inflated cost, leading to a churn rate of 10% per month and a rapidly shrinking customer base, with an effect on its share price that made Blue Apron a business case of IPOs.

This scenario highlights a broader issue facing many businesses that rely on high CAC and anticipates compensating through an even higher Lifetime Value (LTV)—a strategy that becomes unsustainable when customer acquisition costs escalate and consumer commitment wanes.

The increasing reluctance of consumers to engage with and commit to subscriptions only exacerbates this challenge, driving CAC higher and making the pursuit of profitability even more elusive. A real catch-22.

When subscriptions make sense

Software services and entertainment platforms excel in this model because they deliver consistent, tangible user value. Software as a Service (SaaS) platforms, for example, offer businesses scalable, on-demand tools without the high upfront costs of traditional software, while media services provide endless entertainment options at the fingertips of consumers.

As a general rule, we suggest looking at three pillars that justify a recurrent business model:

- Continuous Value Delivery:

- Software (B2B & B2C): Services adapting to an evolving context, with regular updates to keep up with changing needs (eg. regulatory), offer a clear value proposition for ongoing subscriptions.

- Media Consumption: Platforms like Netflix and Spotify provide access to ever-expanding libraries of content, justifying recurring fees.

- Essential Services: Consider daily-used software like Microsoft Office 365 or cloud storage solutions like Dropbox – their continuous value justifies subscription models.

2. Ongoing Support and Updates:

- Technical Products: Subscriptions can ensure access to expert support and timely updates for complex products like security software or enterprise-level applications.

- Evolutionary Content and Personalization: Imagine fitness apps with personalized workout plans or educational platforms with constantly updated courses – subscriptions unlock access to this evolving value.

3. Convenience, availability and retainer

- The convenience of the “set and forget” is valuable to the eyes of some customers by itself.

- Especially for B2B, where prompt availability may be a requirement, it may be justified to charge on a recurrent basis in exchange for an on-demand service that is ready to step in.

- When you effectively need “little use” sharing resources (even in the long term) with other uses helps you mutualize your costs, in exchange for a little “retainer fee” that covers the value of being able to access services on demand (think for instance about the yearly subscription to your car sharing service, that allows you to rent a car for a short time with the swipe of a card).

The subscription nobody asked for.

While there is no doubt that some subscriptions make a lot of sense and perfectly align customer and business interests, we see 3 main categories of subscription models where this alignment may fall short and that will suffer a major re-adjustment:

- Offer fragmentation and category multi-subscription: The allure of video streaming services like Netflix initially lay in their promise to replace DVDs with access to a vast, easily accessible video library from the comfort of one’s couch. However, the increasing fragmentation of digital rights has led to a proliferation of streaming platforms, each holding exclusive content rights. This fragmentation forces over 80% of households to subscribe to multiple services to access the content they desire(https://www.forbes.com/home-improvement/internet/streaming-survey/), significantly diluting the original value proposition of convenience and comprehensive access. The market’s response to this fragmentation suggests a looming reevaluation of how video streaming services bundle and offer content to consumers

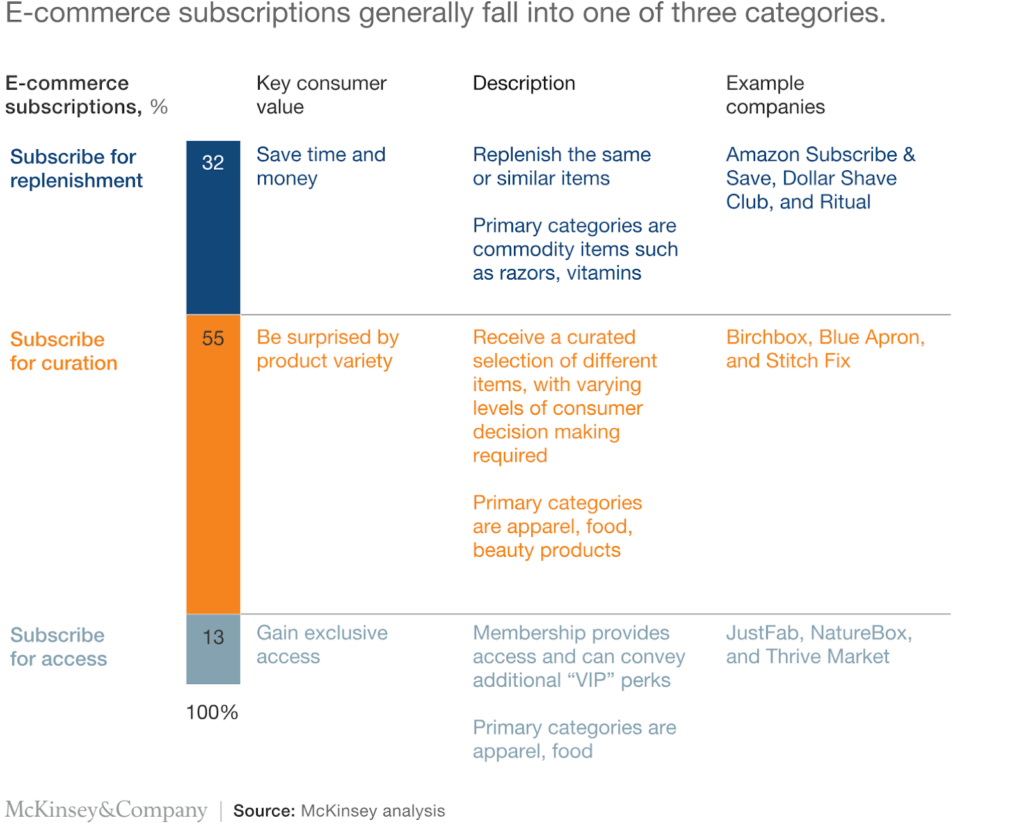

- Shifting Value in E-commerce Subscriptions: The 2018 McKinsey report identified three main types of e-commerce subscriptions (replenishment, curation, and access), offering a framework to understand the value provided by these models. Despite the enduring relevance of this categorization, the advent of subscription fatigue, coupled with market shifts post-COVID and evolving economic conditions, necessitates a fresh appraisal. Companies must critically assess whether their subscriptions continue to deliver value in alignment with changing consumer preferences and economic realities, ensuring they adapt to maintain relevance and appeal.

- The stretched subscription: Not all goods or services lend themselves naturally to a subscription model. This misapplication, termed “the subscription nobody asked you,” highlights instances where subscriptions fail to resonate with consumer expectations or needs. This is the case for instance with:

- Valuing Ownership: Certain products are prized for their ownership value, which subscriptions can dilute. Consumers often seek the exclusivity and permanence of ownership, attributes that subscription models cannot replicate.

- Arbitrary Pricing: Subscription pricing that appears detached from the perceived value or actual consumer willingness to pay can alienate potential subscribers. Price points that merely follow industry norms without reflecting the specific value or cost of the offering may lead to skepticism and reduced uptake.

- Disguised Rentals: Some subscriptions essentially serve as long-term rentals without offering the flexibility typically associated with renting. This approach can frustrate consumers who might seek temporary access but find themselves locked into prolonged commitments. Additionally, financial models like leasing, particularly for hardware products, straddle a fine line between financing assets and creating recurring revenue, requiring clear communication and justification to resonate with consumers.

Alternatives and solutions

- Consider the subscription route with critical eyes: subscriptions are often interesting for the business and sometimes for the consumer. However, keep a critical spirit and keep the Blue Apron story in mind.

- Don’t cover your (CAC) eyes with free trials: The leap from free trials to paid subscriptions is a significant one. Notably, giants like Netflix and Spotify have phased out free trials in markets where their value proposition is well-established, suggesting that free trials are not a one-size-fits-all solution for customer acquisition. The lesson here is clear: use free trials strategically to foster genuine engagement, not as a superficial means to reduce Customer Acquisition Costs (CAC).

- Embracing Usage-Based Metrics: Consider whether a subscription is always the best fit for your value proposition. Usage-based pricing offers an alternative that aligns costs with actual consumer use, potentially providing a fairer and more transparent model. This approach encourages consumers to pay for the value they receive, eliminating the perception of paying for unused services.

- The Strategy of Debundling: Debundling services and offering pared-down subscriptions can help delineate the value provided, making it clearer to consumers what they’re paying for. This approach can demystify the value exchange, ensuring customers feel their investment is justified by the utility and satisfaction derived from the service.

- Continuous Value Delivery: For subscriptions to resonate, they must deliver ongoing value. This means communicating and demonstrating the continuous effort behind the scenes—whether that’s through regular updates, exclusive content, or personalized services. The goal is to make the subscription feel like a service that grows and evolves with the customer’s needs, not a static, one-off purchase.

- Personalization and Hybrid Models: Personalization is a powerful tool in making subscriptions feel tailor-made and valuable. Coupled with hybrid models that blend subscription benefits with one-off purchases or usage-based options, businesses can offer flexibility and choices that resonate with diverse consumer preferences.

- Transparent Communication: Transparency about the nature of the subscription—whether it’s a lease, a rental, a credit arrangement, or a comprehensive service—is crucial. This clarity helps manage expectations and builds trust, making customers more likely to commit to and value the subscription.

- Play fair: Avoid relying on revenue from subscribers who forget to cancel: Netflix’s approach of deactivating inactive accounts is a prime example of leveraging transparency and fairness to enhance customer trust and reduce the burden of unwanted subscriptions. (https://about.netflix.com/en/news/helping-members-who-havent-been-watching-cancel)

- Leverage all this to your advantage, making another pricing model your differentiator and thinking beyond the crowd.

Subscriptions are here to stay, but businesses must anticipate and adapt to changes in customer acceptance. Addressing subscription fatigue isn’t about eliminating subscriptions but reevaluating and realigning them with genuine consumer needs, preferences, and transparency. By balancing the pursuit of predictable revenue with the genuine needs and preferences of consumers, businesses can transform subscriptions from a potential source of frustration into a compelling proposition of ongoing value.

So, before jumping on the recurring revenue bandwagon, ask yourself: are you offering “the subscription nobody asked for,” or are you creating a model that truly resonates with your audience? Choose wisely, and the fight against fatigue might just turn into a symphony of customer satisfaction.

As always, don’t forget to start your pricing exercise by looking at your customers, defining a clear strategy, and only then, going to the pricing drawing board.

My name is Salva, I am a Product executive, helping tech companies discover, shape, and sell better Products. My work and writing are mainly about subscription models, product pricing, e-commerce/marketplaces, and creating top product organizations.

My superpower is to move between ambiguity (as in creativity, innovation, opportunity, and ‘thinking out of the box’) and structure (as in ‘getting things done’ and getting real impact).

I am firmly convinced that you can help others only if you have lived the same challenges: I have been lucky enough to practice product leadership in companies of different sizes and with different product maturity. Doing product right is hard: I felt the pain myself and developed my own methods to get to efficient product teams that produce meaningful work.